Recharged M&A Activity in the Semiconductor Industry

- The MergerSight Group

- Nov 7, 2020

- 10 min read

By Gurneek Gill (UCL), Mustafa Bayramli (Wharton), Amarins Laanstra-Corn, Roshni Padhi (Stanford)

Photo: Christian Wiediger (Unsplash)

I. Background

Semiconductors are materials that have an electrical conductivity value that lies between that of an insulator, such as a ceramic block, and a conductor, like a piece of metal. The most commonly used semiconductor device is called the MOSFET (metal-oxide-semiconductor field-effect transistor) and its silicon variation dominates the semiconductor marketspace by having over 90% of the market share. Semiconductor chips can be employed in a variety of uses in electronic devices. Such is their effectiveness; they can now be found in every mobile and computer-based device as they have become significant fabrication elements for most electronic circuits. Furthermore, other widespread applications of semiconductors can be found in the automotive and industrial sectors.

Ever since the 1960s, the scalability and growth of this industry have been largely driven by companies that have developed extraordinary capabilities from semiconductor chips. The progress can be clearly seen -- in the 1950s, single transistors could be found on semiconductor memory chips, whereas today, there are billions of transistors per chip on microprocessors and memory devices. Memory chips are largely what have consistently driven the growth of the semiconductor industry due to their applicability in central processing units (CPUs) of computers/laptops, which are ever-increasing in popularity. Though Intel largely dominates the semiconductor market for computer applications, Qualcomm pioneers the way in the smartphone system-on-a-chip market, another rapidly growing marketplace given the huge recent prominence of iPhone and Android mobile devices which are seeing many complex enhancements such as 5G. Thus, it is clear to see that the technological revolution that has been occurring in the past 5 years has been a huge contributing factor to the rise of semiconductors; as artificial intelligence begins to take shape, this is only likely to continue. 2020 has reflected this since the total value of semiconductor company-related M&A this year has more than doubled compared to 2019.

Though the semiconductor market size worldwide has been steadily growing for the past 5 years (sales have increased by over 25%), there are some key issues to consider. The global semiconductor industry revenue growth rate for 2019 was in fact -12% YoY, and there are clear reasons for the volatility in the semiconductor industry’s growth. Much of this has been down to macroeconomic factors that have caused market uncertainty. For example, the ongoing trade war between the US and China has not helped proceedings. The semiconductor industry fears that there will be severe disruptions to the supply chain. China has been quickening domestic expansion of semiconductor development which would severely affect some of the top US semiconductor companies that push a lot of their trade there. Also, other worldwide issues such as Brexit uncertainty have produced cross-border regulations which will continue to make it increasingly difficult for small firms to increase their M&A activity, meaning they are missing out on huge potential investments that they need to progress.

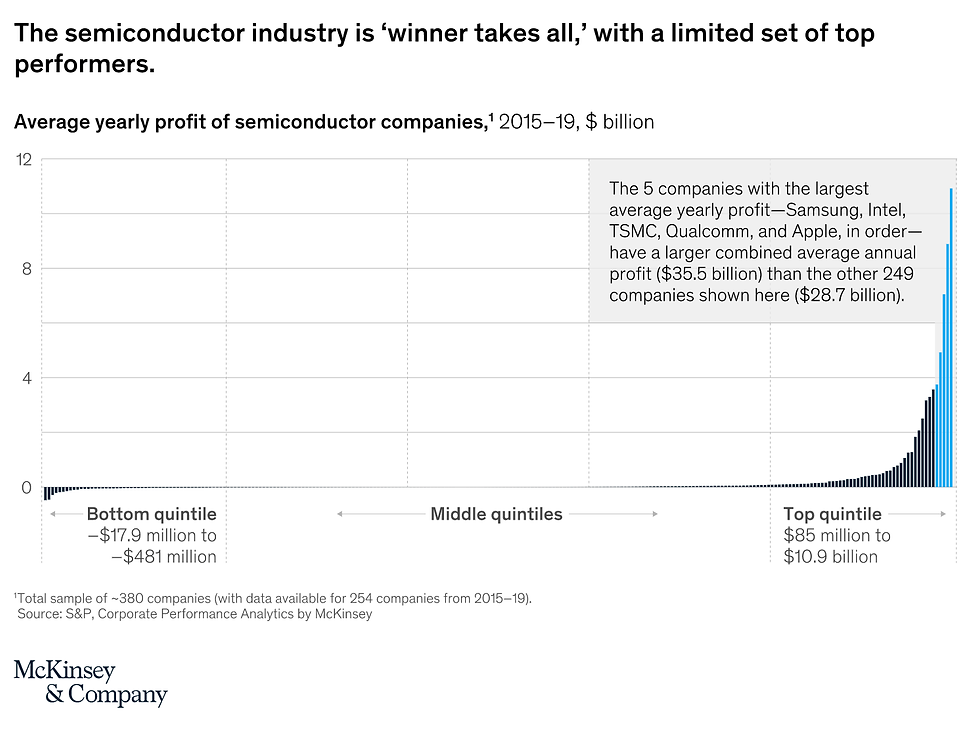

From 2015-2019, the top 5 companies in the semiconductor industry have continued to dominate, based on average yearly profit. These companies are Samsung, Intel, TSMC, Qualcomm, and Apple. In a study done by McKinsey & Co., based on 254 semiconductor companies in the S&P 500, it was found that the top 5 companies in this industry had a combined average yearly profit that was $6.8 billion higher than the other 249 companies combined. This is largely due to larger companies having ample working capital to invest in the more challenging cutting-edge research and development required as chips become even more miniature. Furthermore, the top companies are much better placed to deal with critical supply chain issues such as intellectual property (IP) protection; consequently, this yields market dominance for these well-established companies.

II. Analog - Maxim

Analog Devices, Inc. is a leading analog, mixed-signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices' chips are also incorporated into wireless infrastructure equipment. The company serves clients in industrial, automotive, consumer, and communications markets through a direct sales force, third-party distributors, and independent sales representatives in the United States, the rest of North and South America, Europe, Japan, China, and the rest of Asia, as well as through its Website. It has a strategic collaboration with Pinpoint Science Inc. to advance the development and manufacture of novel nanosensor diagnostics. Maxim Integrated Products, Inc. designs, develops, manufactures, and markets a range of linear and mixed-signal integrated circuits in the United States, China, rest of Asia, Europe, and internationally. The company also provides various high-frequency process technologies and capabilities used in custom designs. It serves automotive, communications and data center, consumer, and industrial markets.

Analog Devices, Inc. and Maxim Integrated Products, Inc. announced on July 13, 2020, that they have entered into a definitive agreement under which ADI will acquire Maxim in an all-stock transaction that values the combined enterprise at over $68 billion. The transaction, which was unanimously approved by the Boards of Directors of both companies, will strengthen ADI as an analog semiconductor leader with increased breadth and scale across multiple attractive end markets.

Under the terms of the agreement, Maxim stockholders will receive 0.630 of a share of ADI common stock for each share of Maxim common stock they hold at the closing of the transaction. Upon closing, current ADI stockholders will own approximately 69 percent of the combined company, while Maxim stockholders will own approximately 31 percent. The transaction is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

“Today’s exciting announcement with Maxim is the next step in ADI’s vision to bridge the physical and digital worlds. ADI and Maxim share a passion for solving our customers’ most complex problems, and with the increased breadth and depth of our combined technology and talent, we will be able to develop more complete, cutting-edge solutions,” said Vincent Roche, President and CEO of ADI. “Maxim is a respected signal processing and power management franchise with a proven technology portfolio and impressive history of empowering design innovation. Together, we are well-positioned to deliver the next wave of semiconductor growth, while engineering a healthier, safer and more sustainable future for all.”

As was the case for many of these prior deals, ADI argues that the Maxim deal -- expected to close in the summer of 2021, provided regulators sign off -- will yield significant cost synergies and give the company more comprehensive product lines to sell to customers in major end-markets such as automotive, industrial, telecom infrastructure and consumer electronics. The company asserts the deal will generate $275 million worth of cost synergies by the end of its second year after closing, and that the combined company will have more than 50,000 products to serve its 125,000-plus combined customers.

The deal is poised to solidify ADI’s leadership position in the analog semiconductor sector with an expected revenue of $8.2 billion and a free cash flow of $2.7 billion. Maxim’s strength in the automotive and data center markets, combined with ADI’s strength across the broad industrial, communications, and digital healthcare markets are highly complementary and aligned with key secular growth trends. With respect to power management, Maxim’s application-focused product offerings complement ADI’s catalog of broad market products. Furthermore, the combination brings together similar cultures focused on talent, innovation, and engineering excellence with more than 10,000 engineers and approximately $1.5 billion in annual research and development investment. The combined company will continue to be a destination for the most talented engineers in multiple domains

Many investors have concerns about the price that ADI is paying for Maxim. With the caveat that ADI expects major deal synergies, the acquisition price (based on where ADI currently trades) is equal to more than 30 times Maxim’s fiscal 2020 (ended in June 2020) EPS consensus of $2.21. There might also be concerns about the fact that Maxim has lost some analog chip share in recent years. IC Insights estimates Maxim’s analog IC sales fell 13% in 2019 to $1.85 billion, worse than the roughly 8% decline seen by the industry overall thanks to a cyclical downturn. ADI, by comparison, is estimated to have seen its analog IC sales drop only 6% to $5.17 billion.

The ADI/Maxim deal is fueling hopes of additional consolidation for a chip industry that has seen numerous mergers and acquisitions over the last seven years, but which has also seen relatively subdued consolidation activity over the last twelve months. This could particularly hold for companies squaring off against ADI and Maxim in the analog/mixed-signal and microcontroller (MCU) markets, which, despite having seen a decent amount of consolidation, are still relatively fragmented.

III. Nvidia - ARM

On September 13, Nvidia announced that it’s going to be acquiring Arm Limited from SoftBank in a $40 billion transaction. Nvidia is a California-based company with more than a $300bn market cap that designs GPU chips with applications in gaming, automotive, and more recently, deep learning in artificial intelligence; 97% of AI computing infrastructure is powered by Nvidia GPUs. Arm is a British semiconductor and software company that designs chips, primarily CPUs. It licenses those designs to other companies that produce chips, and 90% of smartphones around the world actually use its chips thanks to their portability and efficiency.

In terms of the transaction structure, SoftBank will receive $2 billion in cash upon signing, and it’ll receive another $10 billion in cash and $21.5 billion of Nvidia stock at closing. It can also receive an additional $5 billion in a mixture of cash and stock as a performance-based earnout. The $40 billion also includes $1.5 billion of equity compensation for existing Arm employees. Nvidia will be buying all of Arm’s divisions except for its IoT business, buying the company at a 21x sales multiple, and the deal will be immediately accretive. Nvidia’s stock price increased more than 5% after the announcement, indicating that it was viewed favorably at first.

There are several synergies that this deal is expected to capitalize upon. Nvidia is planning to build an international AI research facility in Cambridge, housing a state-of-the-art AI supercomputer, powered by ARM CPUs. In addition, Nvidia gains an incredible position in the market since Arm is partnered with some of its biggest competitors like Intel and Apple – Apple announced this year that it was ditching Intel processors from its new Macs in favor of more efficient Arm technology chips, meaning that Nvidia will essentially be profiting from all of its competitors’ products, which is huge. The transaction will also bring Arm’s expertise in energy efficiency to Nvidia’s data operations – that’s an amazing opportunity for big tech and data companies who require large amounts of energy to run millions of computer chips around the clock. Lastly, Huang wants to license Nvidia products to Arm’s partners.

In terms of existing concerns, Arm currently prides its business model on neutrality, and it’ll be difficult to keep that fair and honest when it’s selling to Nvidia’s competitors. Furthermore, US-China tensions are at an all-time high, which doesn’t bode well for the deal. The biggest issue is concerning antitrust and regulatory agencies – the deal has to be approved by the US, UK, and China, which is hard enough as it is, but the co-founder of Arm also started a campaign to get the UK government to interfere in the deal. Although the fall in cross-border M&A has been seen across all sectors, it is important to note that in 2016 there were $41 billion in cancelled semiconductor-related acquisition agreements, principally because companies could not obtain government approvals required for transactional completion.

Overall, the deal represents further consolidation in the industry to reflect recent innovations. As companies invest more in R&D, scientists have found entirely new applications of semiconductor technology, ranging from automobiles to mobile phones. Coupled with developments in artificial intelligence, firms like Nvidia are poised to revolutionize the technology industry, impacting customers all over the world.

IV. AMD - Xilinx

Advanced Micro Devices Inc is a high-tech computer processor company based out of Santa Clara, California. Through pivotal partnerships with both Intel and the U.S. Military, AMD has secured its place as a superpower in the semiconductor industry Their main products include microprocessors, motherboard chipsets, and embedded processors for a variety of consumers, ranging from servers, individuals, and embedded systems. AMD’s current CEO is Lisa Su and as of May 2020, their revenue stands at 7.2 billion, their assets at 5.2 billion, and profits at 487 million.

Xilinx is a semiconductor company specializing in computer processing platforms based out of San Jose, California. Xilinx was the founder of the fabless model, the practice of outsourcing production overseas primarily to China or Taiwan. Xilinx is also credited with the creation of the field-programmable gate array, programmable system on chips, and the adaptive compute acceleration platform. The current CEO is Victor Peng, and in the current fiscal year, revenue is recorded at 3.2 billion, assets at 4.7 billion, and profits at 792.7 million.

In October 2020, it was announced AMD would acquire Xilinx for 35 billion USD. This would be an all-stock acquisition, leveraging AMD’s current share price to enable a price of roughly 143 USD for Xilinx share. This will result in AMD shareholders owning 76 per cent of Xilinx and while 26 percent of the company will remain with the Xilinx shareholders. This deal will propel AMD’s new valuation to approximately 110 billion USD. Victor Peng, Xilinx’s current CEO, will join the transition to AMD to oversee Xilinx projects at AMD and Xilinx will be offered two board seats at AMD. The deal is claimed by AMD to help them save 300 million USD on 300 million USD synergistic operational efficiencies within eighteen months of closing. This fits into AMD’s current market plan of growing a diverse growth market combined with the development of innovative products to compete against major superpowers such as Intel.

This deal is a risky move for AMD as they previously almost went bankrupt in 2006 after an attempted acquisition and much of CEO Su’s tenure has been trying to reverse the mistakes of her predecessors and manage the leftover debt. However, Su has remained publicly optimistic about this deal stating that she feels it will define the industry for five to ten years to come. Yet it comes in trend with recent semimotor sector activity. As more mergers and acquisitions have been happening in the past two years, the industry has seen a rebound from stalled growth. The consolidation of the industry is crucial as top companies try to achieve greater market weight and offer consumers a variety of integrated new products.

V. Future Outlook

2020 has been the second-highest year of merger and acquisitions in the semiconductor industry. As of October 2020 and excluding any additional activity in quarter 4, the total value of M&A in the industry is approximately sixty billion. This comes after the sector was experiencing a sharp decline in merger and acquisition activity in the 2010s, only returning to the upward trend in 2019. The total value of M&A activity in 2017, 2018, 2019 was on average thirty billion. This increase in value is indicative of potential steady growth over the upcoming years. This becomes additionally solidified as growth has been achieved even in the face of the COVID-19 pandemic. And not to be understated, as there was significant pressure for the semiconductor sector to rebound in 2020 after previously mentioned stalled growth.

However, in the face of long term advancement, the semiconductor sector will face considerable uncertainty. This is partly due to the spillage of COVID-19 effects on macroeconomic growth, the healthcare industry, and research and development industries. The new pull towards sophisticated virtual communication could significantly impact the demand toward the semimotor industry, as there will be a drive toward sectors that support servers, connectivity, and cloud usage. Yet, according to a study conducted by McKinsey, forecast demand does not appear that it will reach pre-COVID levels until 2021.